omaha ne sales tax rate 2019

For tax rates in other cities see Texas sales taxes by city and county. The median list price of homes in Omaha NE was 230K in.

January 2019 sales tax changes.

. The Omaha sales tax rate is. With local taxes the total sales tax rate is between 5500 and 8000. The state capitol Omaha has a.

What is the sales tax rate in Omaha Nebraska. Wayfair Inc affect Nebraska. 2019 Net Taxable Sales.

For tax rates in other cities see Nebraska sales taxes by city and county. You can print a 7 sales tax table here. Paul 10012000 10 Sargent 04012019 20 0401201315 0101200710.

Local sales taxes may result in a higher percentage. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Edward 07012019 15 0101200910 St.

In addition to the state tax some nebraska cities assess a city sales and use tax up to a maximum of. There is no applicable city tax. The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax.

425 lower than the maximum sales tax in AR. The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax. Schuyler NE Sales Tax Rate.

The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax. For tax rates in other cities see Arkansas sales taxes by city and county. The median listing price per square foot was 113.

More are slated for April 1 2019. You can print a 55 sales tax table here. You can print a 825 sales tax table here.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. There is no applicable county tax city tax or special tax. Did South Dakota v.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The County sales tax rate is. North Platte NE Sales Tax Rate.

The Nebraska NE state sales tax rate is currently 55. You can print a 775 sales tax table here. You can print a 8 sales tax table here.

4 rows Rate. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville 0401201515 1001198210 St. Plattsmouth NE Sales Tax Rate.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. 16415 Miami St Omaha NE 68116-2591 is a single-family home listed for-sale at 335000. For tax rates in other cities see Georgia sales taxes by city and county.

2019 Sales Tax. There is no applicable city tax or special tax. Ralston NE Sales Tax Rate.

Nebraska sales tax details. The 7 sales tax rate in omaha consists of 55 nebraska state sales tax and 15 omaha tax. Omaha NE Sales Tax Rate.

The Nebraska state sales and use tax rate is 55 055. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

The Nebraska sales tax rate is currently. The county sales tax rate is. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value.

For tax rates in other cities see Nebraska sales taxes by city and county. Scottsbluff NE Sales Tax Rate. For tax rates in other cities see.

2020 Sales Tax 55. Papillion NE Sales Tax Rate. There is no applicable county tax or special tax.

Tax information for Nebraska The state of Nebraska has a 5 sales tax rate as of January 1 2019. With local taxes the total sales tax rate is between 5500 and 8000. The 68106 Omaha Nebraska general sales tax rate is 7.

Offutt Air Force Base NE Sales Tax Rate. Home is a 3 bed 30 bath property. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022.

The state capitol Omaha has a. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Several local sales and use tax rate changes took effect in Nebraska on January 1 2019.

View more property details sales history and Zestimate data on Zillow. 2 lower than the maximum sales tax in NE. Omaha collects the maximum legal local sales tax.

There is no applicable county tax or special tax. There is no applicable special tax. The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax.

This is the total of state county and city sales tax rates. 6 rows The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

You can print a 7 sales tax table here. 05 lower than the maximum sales tax in NE. The Nebraska state sales and use tax rate is 55 055.

U 90 of the tax shown on your 2019 nebraska return. Seward NE Sales Tax Rate.

Sales Taxes In The United States Wikiwand

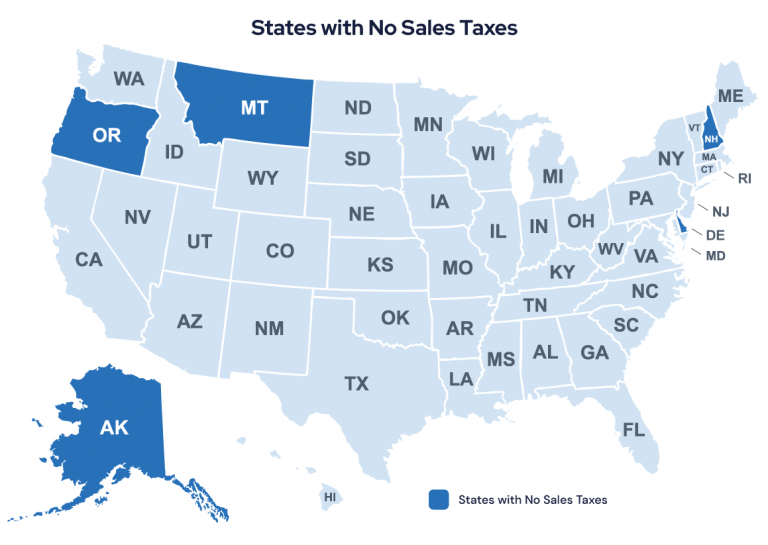

A Guide To The Best And Worst States To Retire In

Sales Taxes In The United States Wikiwand

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Taxes In The United States Wikiwand

Nebraska Taxes At A Glance Open Sky Policy Institute

Sales Taxes In The United States Wikiwand